Roblox is delivering sustained growth, with an exciting product pipeline, large market potential, and a strong team. I am building a position between $25/share and $29/share with a 10x upside over five years, and downside limited to 30%.

Roblox is trading at an attractive price after Q2 ‘23 due to a near-term slow down in growth and low cash flow. However, annual growth was still around 20% on most metrics and, given the product pipeline, I expect years of growth ahead.

Investors selling Roblox may see the platform as simply a video game company. Roblox is trading at a steep premium to Nintendo and faces tough competition from Fortnite Creative and Minecraft, both with similar social features and custom experiences.

To see a 10x gain, or Roblox reaching its goal of 1 billion players, we need to look at the paradigm change Roblox is driving to create. Like instagram made sharing photos easy, Roblox is aiming to make creating online experiences easy. Instead of thinking of Roblox as a game platform, we can think of Roblox as a software development platform.

Analogs to the paradigm change exist throughout media. We can look at YouTube taking share away from traditional television for example. Once content is sufficiently easy for an individual to make, there is a large wave of creators that fill every niche. Today, building a game on Roblox is much harder than creating a video for TikTok or sharing an image on Instagram, but making a game is getting rapidly easier. Building a game no longer takes an advanced degree, specialized equipment, or a studio. Individual young people are able to make games.

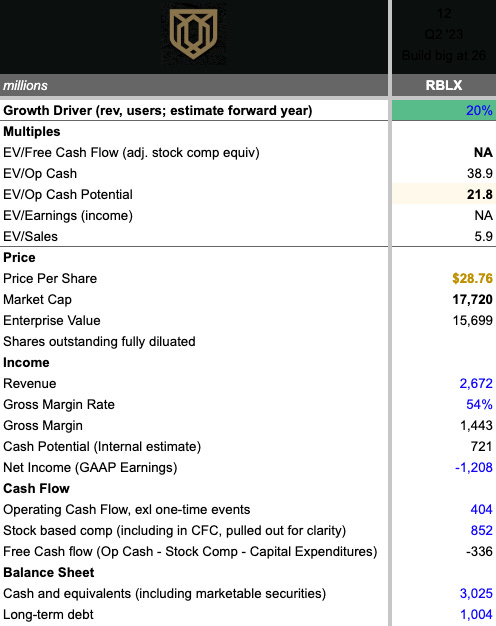

Fundamentals:

At $17.5B market cap, Roblox is trading at over 20 EV/Op Cash Potential, near the high end what I am comfortable with for a growing company, with a strong moat. Estimating the downside, I consider a move to 17 or 18 EV/Op Cash Potential, which would result in Roblox trading around $24/share. I am starting to build the position so I don’t miss the upside when the market starts to recover.

Over the next 12 months, Based on management guidance and a history of delivering, I see Roblox having a record quarter in Q4 ‘23 from adding users, adding developers, increasing engagement (voice, friending, avatars), seasonality, and releasing a full-scale ad marketplace. Additionally Roblox will achieve cost efficiencies with AI in Q4.

The biggest risk in the next 12 months is competition weighing on Roblox’s valuation multiples and growth rate, especially if enthusiasm around Fortnite Creative continues to grow. I see Roblox continuing to have a leadership position, but it is no longer the only player in development and distribution of custom games at scale. Fortnite creative is still much smaller than Roblox in terms of daily active, at less than half the size, but growing quickly and from a remarkable strong platform.

Upside Highlights

Advertising Market Place

Advertising is the core business for most social platforms (META, SNAP, etc.) and Roblox has yet to monetize with Ads.

In the two-year time horizon I could see revenue from ads contributing roughly $2 Billion, or just shy of doubling Roblox’s current revenue. This is a bottom-up calculation, using a midrange for advertising revenue per player, only considering North American & Europe players, and assuming 20% growth in players. The calculation is a rough estimate and it may take more than two years to reach $2B ad revenue, but the take away here is the same - ads are not simply an ‘add-on’ revenue stream, but have the potential to be a core part of Roblox revenue.

Civility & More Powerful of Developer Tools

With tough competition from Minecraft and Fortnite, we need to look closely at where Roblox will differentiate over the next two to five years. We need to also consider if the market is approximately winner takes all (like Uber/Lyft) or if it is a multi-winner market like music streaming (Spotify, Apple Music) and gaming devices (Playstation, Xbox, Quest, PC). Without getting too deep into the discussion, it seems most likely online experiences will be multi-winner.

Safety & Civility

Roblox is certainly the leader among its peers in safety and civility. This is achieved through both player rules and technology. For example, Roblox has stricter rules than Fortnite on how players connect on chat and Roblox appears to have the most advanced AI models for recognizing potentially harmful speech.

Developer Tools & Breadth of Experiences

Roblox developers can create experiences that are as diverse as role playing games, with character development over months and years, to games inspired by Mr. Beast and popular shows such as Squid Games.

Both Fortnite and Roblox have non-game experiences such as concerts, but Roblox is putting more emphasis on non-game experiences and expressive avatars.

Roblox also takes care of all the engineering required to deliver new experiences to players (scaling, database services, multi-platform, and much more). Fortnite does this as well - but it’s the breadth of experiences that scale across all platforms that differentiations Roblox.

Standard components, textures, and templates

Language Translation

Safety

Recommendation & Discovery

Generative AI for Development & Ads

Team

Teams are classically hard to quantify, but Roblox seems to have brought a great group of people together. Roblox is hiring the top talent from other leading tech companies including Meta and anecdotally is more selective than companies like Google or Microsoft.

The team also has a history of delivering. Roblox has produced consistent growth over the last five years and avoided over hiring (which was a mistake many tech companies made in 2021).

Key Risks

Roblox existential risk is players leaving the platform after a couple years. Though RBLX recently released a 17+ category and growth in number of daily players over 13 is >30% year-over-year, the average churn per-quarter is 20% and the average life-time engagement of a player is 2.5 years. This is sharply lower than other brands which could retain a user for over a decade.

Most worrisome is that there has been little improvement in churn reduction highlighted by management.

Additionally, the key thesis of enabling developers and customer experiences is being challenged by established video game leaders, including Fortnite (10-14M DAU, owned by EPIC ) and Minecraft (12M DAU, owned by Microsoft). Both games are much smaller than Roblox’s 65M DAU, but pose competition.

List of Risks

Players leaving Roblox (medium)

Evidence of Risk: churn rate of about 20% per period, while 20% additions per period keeps users near flat; lifetime only 28 months, compared to other platforms that might have lifetime closer to a decade

Mitigation: full effort of the Roblox team is focused here, from enabling 17+ Age group experiences, to building Roblox for additional platforms (VR, Xbox, Playstation), to emphasizing durable social connections

Churn has not gotten worse

Net-player count still increasing overall

Developers leaving Roblox (medium)

Evidence: Fortnight custom games are exceptionally popular, generating more playtime than the original core game. Additionally, the social aspect of games like fortnight are as strong Roblox’s in many demographics (non-game experiences like concerts, chat, friending, seasons)

Mitigation: Roblox offers developers unparalleled freedom to create unique experiences (games and non-games). Likely there will be demand for this wide range of content.

No sign of net developer migration away

Valuation risk (medium)

Evidence: RBLX is pricy relative to operating cash. If growth expectations falter further, we could see Price / Op Cash compress towards 30, representing a 25% downside, and a stock price around $24

Mitigation: upside potential greater than 200% outweighs the downside valuation risk

Cash flow risk (low)

Evidence: currently operating with deeply negative free cash flow; stock based compensation 5% of market-cap annually

Mitigation: management is planning for conservative spending growth into 2024, driven by disciplined hiring and internal server management.

Economic risk (low)

Evidence: global growth is slowing

Mitigation: Roblox is not a high expense, delivers great value per dollar in terms of hours of entertainment, low likelihood of being cut if consumers bring down spending.